Key Takeaways:

- Since its last earnings report, Fortinet’s stock has experienced a 33% decline, following results that fell short of analyst expectations and a forecast that was less optimistic than anticipated.

- The company is transitioning towards Secure Access Service Edge (SASE) and secure operations.

- Fortinet’s management expects billings growth to return to double digits by the second half of 2024.

Company Overview:

Fortinet Inc. (NASDAQ: FTNT) is a global leader in broad, integrated, and automated cybersecurity solutions. It has established its prominence in the cybersecurity world by providing top-tier hardware and software services. The company’s commitment to innovation and customer satisfaction has solidified its position as a trusted partner in network security.

Fortinet’s Strategic Pivot Amidst Market Challenges

Fortinet Inc., a leader in cybersecurity solutions, encountered significant market volatility following its Q3 earnings report. The results highlighted challenges in execution and a downturn in the hardware market, attributed to post-COVID adjustments. This period marked a deviation from Fortinet’s traditionally robust performance, raising concerns among investors and industry analysts.

Despite these hurdles, Fortinet’s management team remains confident about the company’s long-term trajectory. They anticipate a resurgence in growth by the second half of 2024, driven by strategic shifts towards high-growth sectors like Secure Access Service Edge (SASE) and secure operations. This pivot reflects an adaptation to the changing demands of the cybersecurity landscape and a commitment to innovation.

A key aspect of Fortinet’s strategy is its partnership with Google, which expands its global Points of Presence (PoPs) and enhances its SASE offerings. This collaboration is crucial for Fortinet’s ambition to establish a stronger foothold in the SASE market, a segment that’s gaining increasing relevance in network security.

However, the company’s Q4 billing projections suggest a potential 5% decline, an indication of ongoing challenges in the market. This outlook is partly due to slower growth in the secure networking segment, which has been affected by prolonged sales cycles and cautious customer spending.

In response, Fortinet is intensifying its focus on sales efforts and investing in faster-growing segments like Secure Operations and Universal SASE. These initiatives are part of a broader strategy to diversify Fortinet’s revenue streams and reduce reliance on traditional hardware sales, which have faced headwinds in the current economic climate.

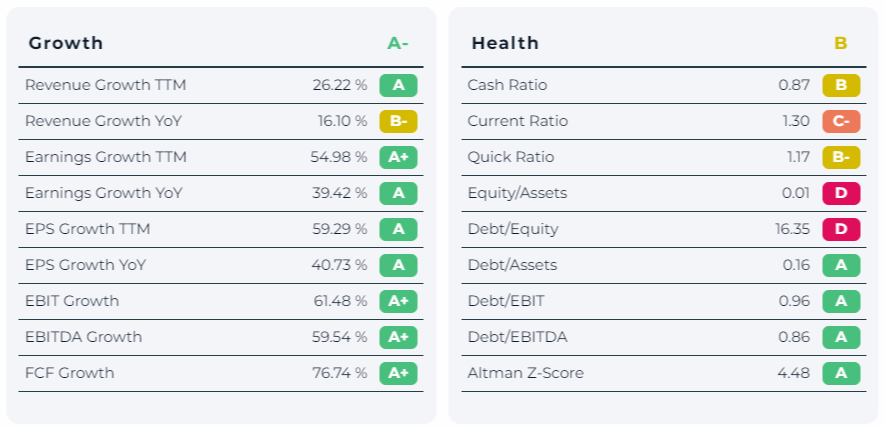

Recent Financials:

Fortinet’s financial performance in Q3 revealed a resilient stance amidst market challenges, with billings reaching $1.49 billion, a 6% increase year-over-year. This growth, albeit moderate, signals the company’s ability to maintain momentum in a complex market environment.

Looking ahead to Q4, Fortinet projects a slight decrease in billings, indicative of the broader industry’s normalization and specific challenges in the secure networking sector. Despite these headwinds, the company’s financial fundamentals remain strong, with projected operating margins exceeding 25%. This robust margin performance is a testament to Fortinet’s disciplined approach to operational efficiency and strategic spending.

The company’s resilience is further underscored by its ability to sustain significant margins, ranging between 26-27% in recent years. This financial stability, coupled with strategic initiatives in expanding service offerings and pivoting towards high-growth segments like SASE and secure operations, positions Fortinet well for navigating current market challenges and capitalizing on future growth opportunities.

Financial Bullet Points:

- Q3 Billings: $1.49 billion, up 6% YoY

- Q4 Billings Guidance: $1.63 billion, down 5% YoY

- Revenue Growth: Consistent year-over-year increase in revenue

- Net Income: Healthy net income figures, indicating robust profitability

- Profit & FCF Margins: increased due to higher service margins and revenue mix

Business Model & Competitors Analysis:

Fortinet’s business model centers around providing integrated cybersecurity solutions. They are expanding into the SASE market, competing against major players like Zscaler and Palo Alto Networks. Fortinet differentiates itself with a focus on SMBs and a robust hardware product line. Their current focus on SASE and secure operations segments aims to counterbalance the slowdown in hardware sales. Fortinet’s approach includes a strong emphasis on internal development over acquisitions.

SWOT Analysis:

- Strengths: Market leader in firewall solutions, strong hardware products, established customer base.

- Weaknesses: Over-reliance on hardware sales, slow adaptation to next-gen markets.

- Opportunities: Expansion into SASE, partnerships with companies like Google.

- Threats: Intense competition in cybersecurity, macroeconomic challenges.

Investment Outlook:

Fortinet’s pivot towards SASE and secure operations, coupled with its robust operating margins, paints a promising picture for future growth. The company’s focus on maintaining operational efficiency and expanding its service offerings is expected to drive a rebound in billings growth by the second half of 2024. Fortinet’s resilience in the face of current market challenges suggests potential for long-term value creation for investors.

After conducting a comprehensive 10-year forecast, our analysis indicates that Fortinet’s current valuation appears to be justifiable, taking into account a range of scenarios. These scenarios are grounded in conservative (low), moderate (mid), and optimistic (high) financial assumptions, providing a robust framework for evaluating the company’s long-term potential.

Concluding Remarks:

In conclusion, Fortinet Inc. represents a compelling blend of innovation, financial strength, and strategic market positioning in the dynamic cybersecurity sector. With its focus on cutting-edge technology and customer-centric solutions, Fortinet is well-equipped to navigate the challenges and opportunities that lie ahead.

Financial Data Source: https://finqube.io/

Disclosure according to §34b WpHG because of possible conflicts of interest: The author is not invested in the discussed securities or underlying assets at the time of publication of this analysis.