Key Takeaways:

- Alibaba Group is focusing on AI-driven technology and a global commerce network as key priorities for the next decade.

- Recent restructuring introduces a “1+6+N” governance model, fostering agility and innovation.

- Alibaba is intensively investing in core businesses, distinguishing them from non-core segments.

- The company remains committed to shareholder returns, with significant share repurchases + dividend payment in fiscal year 2024.

- Alibaba’s cloud computing platform is the third largest globally, emphasizing AI and cloud convergence.

Company Overview:

Founded in 1999, Alibaba Group Holding Limited began with a mission to empower small businesses through digital innovation. Today, it stands as a global leader in e-commerce, cloud computing, digital media, and other technological innovations. The company’s foundation lies in addressing customer needs and fostering an ecosystem where all participants create and share value. Known for its massive online marketplaces, Alibaba has expanded its reach into various sectors, positioning itself as a key player in the digital economy.

Alibaba’s Strategic Shift: Embracing AI and Global Commerce

Alibaba Group, under the leadership of CEO Yongming ‘Eddie’ Wu, is at a pivotal juncture, redefining its strategic direction to stay ahead in the rapidly evolving digital landscape. The company’s recent earnings call highlighted significant shifts in its operational and strategic focus, emphasizing the importance of AI-driven technology and a global commerce network as its primary growth drivers for the next decade.

The company is undergoing a transformation, focusing on establishing a nimble and fast decision-making governance structure. This shift is crucial as Alibaba contends with rapidly developing technologies and changing market expectations. The corporate governance reforms initiated this year aim to enhance the company’s entrepreneurial mindset and improve its decision-making systems.

Alibaba is also conducting a strategic review of its existing businesses, distinguishing between core and non-core segments. After 24 years, Alibaba is evolving from a single company into a new governance model of “1+6+N” in which major business groups and various companies have independent operations.

“1” represents Alibaba Group’s holding company, “6” refers to six major business groups – Cloud Intelligence Group, Taobao and Tmall Group, Local Services Group, Alibaba International Digital Commerce (AIDC) Group, Cainiao Smart Logistics Network Limited, and Digital Media and Entertainment Group, and “N” refers to various businesses such as Alibaba Health, Sun Art Retail, and Freshippo.

The company is intensively investing in its core businesses, pursuing R&D, and enhancing user experiences to ensure long-term vitality and competitiveness. This approach is expected to maximize synergy across business groups, striking a balance between independence and cooperation.

In terms of financial performance, Alibaba remains committed to delivering shareholder value. During fiscal year 2023, the company repurchased approximately US$10.9 billion of its shares, representing a significant portion of its free cash flow. This move underscores Alibaba’s confidence in its financial health and long-term prospects.

Moreover, Alibaba’s cloud computing platform, the third largest globally, is set to play a pivotal role in the company’s future. The convergence of AI and cloud computing is identified as a key impetus for future development, signaling Alibaba’s commitment to technological innovation and transformation.

In summary, Alibaba Group is strategically positioning itself to navigate the challenges and opportunities of the new digital era. By focusing on AI-driven technologies, global commerce, and a reinvigorated corporate structure, the company is poised to unlock new growth avenues and reinforce its market leadership.

Recent Financials:

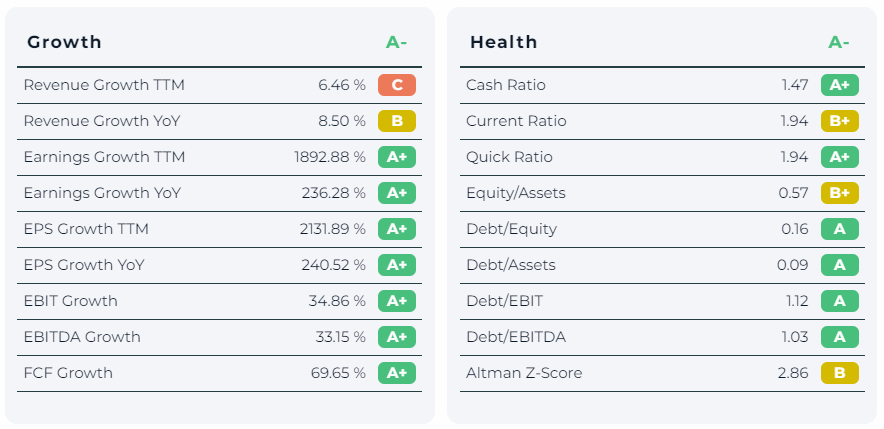

Alibaba’s diverse business model, spanning from China commerce to international commerce and digital media, has enabled it to maintain financial stability. Despite global economic fluctuations, Alibaba generated substantial free cash flow, evidencing its robust financial health. The company’s strategic investments in new technologies and talent, coupled with a significant share repurchase program, reflect its commitment to long-term value creation and shareholder returns.

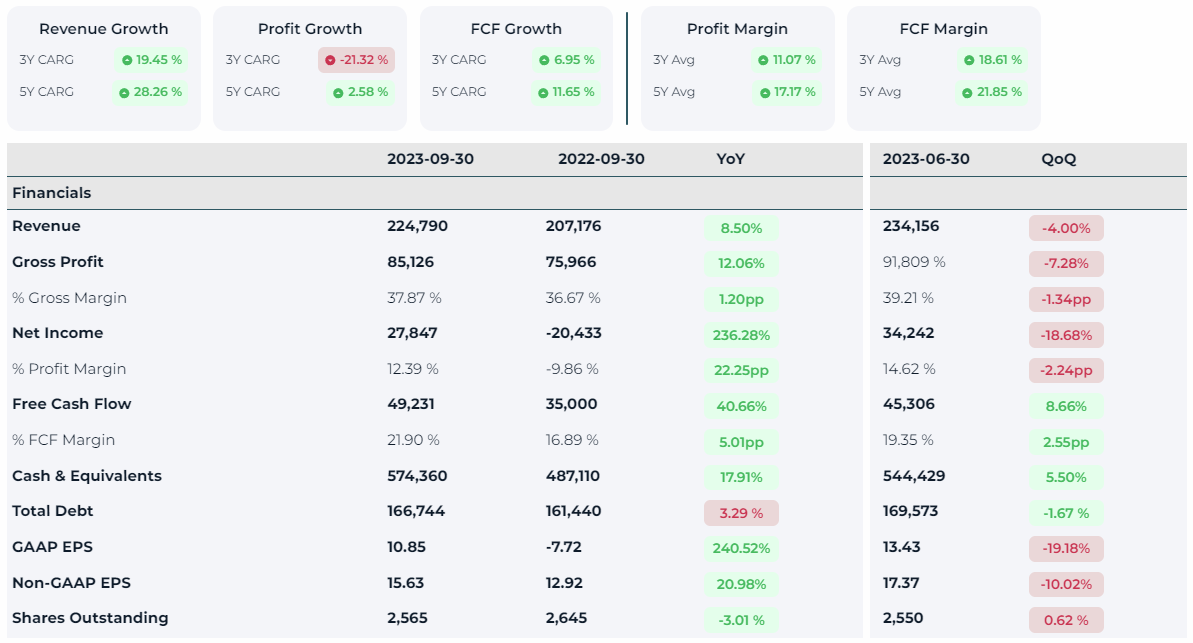

Alibaba’s financial performance over the past few years has been noteworthy. The company has experienced a 5-year CAGR free cash flow growth of 12% and a FCF margin of 22%. Additionally, its 5-year CAGR revenue growth over the same period was about 28%. Despite the market’s negative sentiment, Alibaba’s net debt stands at an impressive -$51.48 billion, with a market capitalization of $183 billion. The fiscal year 2023 has shown improvement across all business segments, with notable growth in international commerce and steady performance in local services, digital media, and cloud services. Alibaba’s ability to maintain profitability and generate substantial cash flow, despite challenging market conditions, and political concerns speaks to its financial resilience and operational efficiency.

Financial Bullet Points:

- Revenue: RMB 224.79 billion (2023-09-30), up 8.5% YoY.

- Gross Profit: RMB 85.13 billion (2023-09-30), 12.06% increase YoY.

- Net Income: RMB 27.85 billion (2023-09-30), significantly up from a previous year’s loss.

- Gross Margin: 37.87% (2023-09-30), an increase from 36.67% the previous year.

- FCF Margin: 21.90% (2023-09-30), an increase from 16.89% the previous year.

Business Model & Competitors Analysis:

Alibaba’s business model is diverse, spanning e-commerce, cloud computing, digital media, and entertainment. Its major e-commerce platforms, Taobao and Tmall, are the cornerstone of its success, offering a wide range of products and services. Alibaba Cloud, the digital backbone of the company, provides cloud services and solutions, supporting businesses globally.

In terms of competition, Alibaba faces challenges from domestic players like Tencent and JD.com, as well as international giants like Amazon and Google, especially in cloud computing and digital services.

SWOT Analysis:

- Strengths: Strong market presence, diverse business portfolio, robust cloud computing services.

- Weaknesses: Regulatory and political challenges, dependence on the Chinese market.

- Opportunities: Expansion in international markets, advancements in AI and technology.

- Threats: Intense competition, geopolitical tensions, and changing market dynamics.

Investment Outlook:

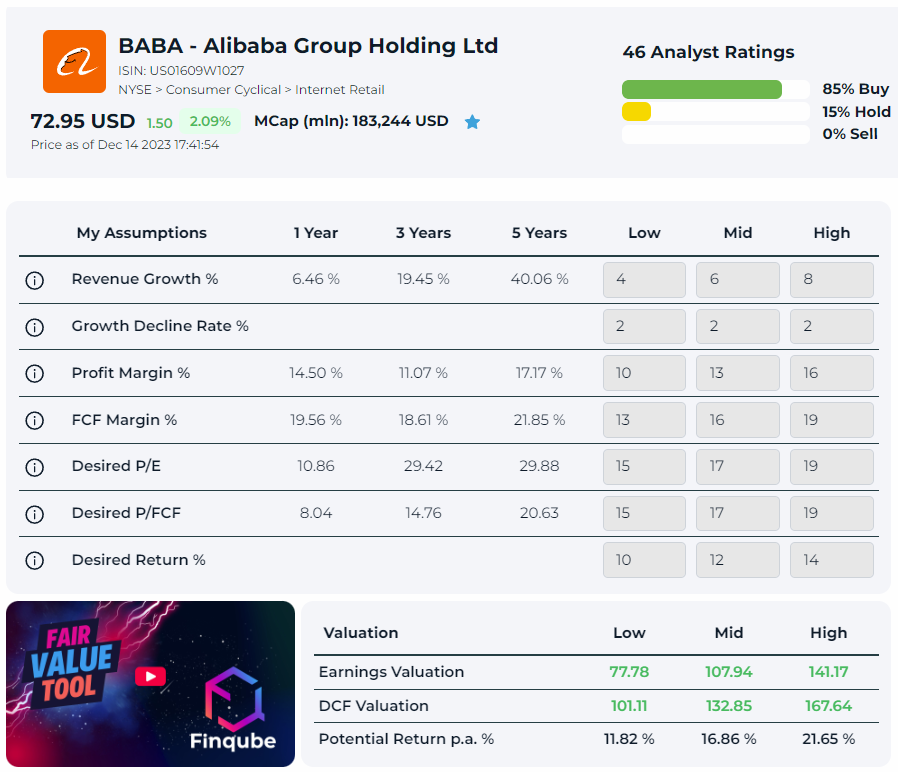

Alibaba’s current market valuation appears significantly undervalued, especially when considering its robust financials and market position. Analysis using discounted cash flow models suggests even with very low assumptions, that Alibaba’s fair value is more than double its current stock price. This undervaluation presents a substantial opportunity for investors. The company’s financial health, combined with its potential for growth and recovery, makes it a compelling choice for those looking to invest in a company with a strong foundation and promising future prospects. Despite the recent political challenges and market volatility, Alibaba’s fundamentals and strategic positioning hint at a significant upside potential in the coming years.

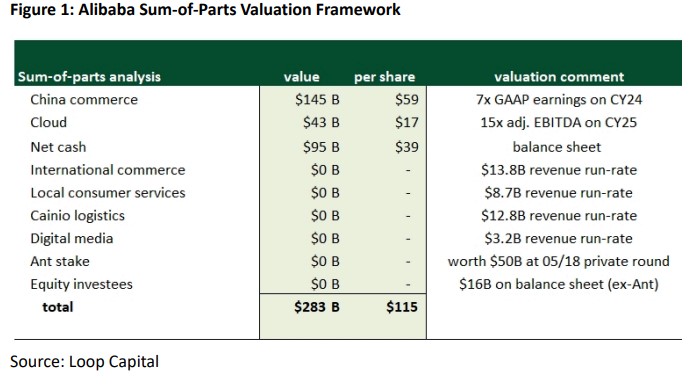

Loop Capital holds a perspective that Alibaba’s valuation does not factor in its international commerce, local services, logistics, digital media, and Ant Group segments. Despite this, they have set a price target of $115 for Alibaba, indicating a potential 65% upside. They also observe that the core e-commerce business of Alibaba is currently valued at 7 times earnings, which they consider to be a subdued valuation. Under more typical market conditions, Loop Capital suggests that a more appropriate multiple for this segment would be around 15 times earnings.

Concluding Remarks:

Alibaba Group is at a transformative phase, strategically positioning itself for the future. With a strong financial foundation, a focus on AI and technology, and a commitment to core business segments, Alibaba is well-equipped to navigate the challenges and seize the opportunities of the digital era.

Financial Data Source: https://finqube.io/

Disclosure according to §34b WpHG because of possible conflicts of interest: The author is not invested in the discussed securities or underlying assets at the time of publication of this analysis.