Company Overview:

PayPal, a long-standing leader in digital payments, faces stiff competition and evolving market dynamics. Despite this, its extensive user base and strategic acquisitions keep it at the forefront of the industry.

Detailed Analysis & Recent News:

PayPal’s stock has experienced significant volatility, recently hitting a six-year low. However, analysts are optimistic, partly due to the “Buy Now, Pay Later” trend and strategic leadership under new CEO Alex Chriss. Despite facing competition from Stripe and Adyen, PayPal’s extensive user base of over 431 million remains a strong asset.

Financial Bullet Points:

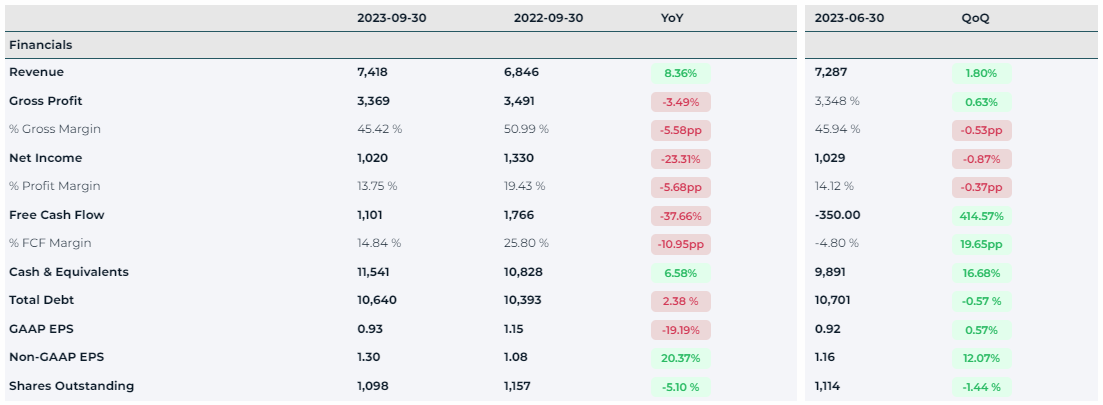

- Revenue (Q3 2023): $7.418 billion, up 8% from $6.846 billion in Q3 2022.

- Gross Profit (Q3 2023): $3.369 billion, down from $3.491 billion in Q3 2022.

- Net Income (Q3 2023): $1.020 billion, decreased from $1.330 billion in Q3 2022.

- Adjusted EPS (Q3 2023): $1.30, up from $1.08 in Q3 2022.

- Total Payment Volume (Q3 2023): Increased by 15% to $387.7 billion.

- Active Accounts (Q3 2023): Decrease from 432 million to 428 million compared to the previous year.

Latest Quarterly Results:

PayPal’s Q3 results beat estimates, with an adjusted EPS of $1.30 and revenues growing 8% to $7.4 billion. Despite a decrease in active accounts, the number of payment transactions rose by 11% to approximately 6.28 billion.

Market Competitors Analysis:

With a user base exceeding 431 million, PayPal dwarfs competitors like Block (44 million active users) and Adyen (40,000 consumers). The company’s scale and consistent cash flows underscore its market dominance, despite facing challenges from emerging players.

Business Model Analysis:

PayPal’s diverse portfolio, including Zettle, Venmo, and Braintree, offers a broad spectrum of payment solutions. The company’s focus on small businesses and innovative technologies like AI positions it well for future growth.

SWOT Analysis:

- Strengths: Large user base, diversified revenue streams, strategic leadership.

- Weaknesses: Declining unit economics, intense competition.

- Opportunities: Growth in digital payments, potential for strategic acquisitions.

- Threats: Regulatory changes, cybersecurity risks, economic fluctuations.

Investment Outlook:

PayPal’s current valuation at 9 times next year’s projected EPS suggests undervaluation. Analysts predict a potential CAGR of ~20% over the next 4+ years. The company’s ability to generate consistent cash flows and strategic importance in the financial sector make it an attractive investment option.

After conducting a comprehensive 10-year forecast, our analysis indicates that PayPal’s current valuation appears to be justifiable, taking into account a range of scenarios. These scenarios are grounded in conservative (low), moderate (mid), and optimistic (high) financial assumptions, providing a robust framework for evaluating the company’s long-term potential.

Concluding Remarks:

PayPal’s journey through a competitive landscape highlights its resilience and potential for growth. While risks are inherent in the fintech sector, PayPal’s strategic positioning, vast user base, and financial strength make it a compelling option for investors seeking a balance between stability and growth potential.

Financial Data Source: https://finqube.io/

It’s worth noting that PayPal Holdings Inc may or may not do well as the tech and finance industry is highly competitive and unpredictable. It’s essential to do your own research and invest wisely. Disclosure according to §34b WpHG because of possible conflicts of interest: The author is not invested in the discussed securities or underlying assets at the time of publication of this analysis.