Key Takeaways:

- Innovation and expansion in new tech frontiers are key growth drivers.

- Long-term outlook hinges on successful execution of strategic initiatives.

- Intel unveils new AI chip to compete with Nvidia and AMD

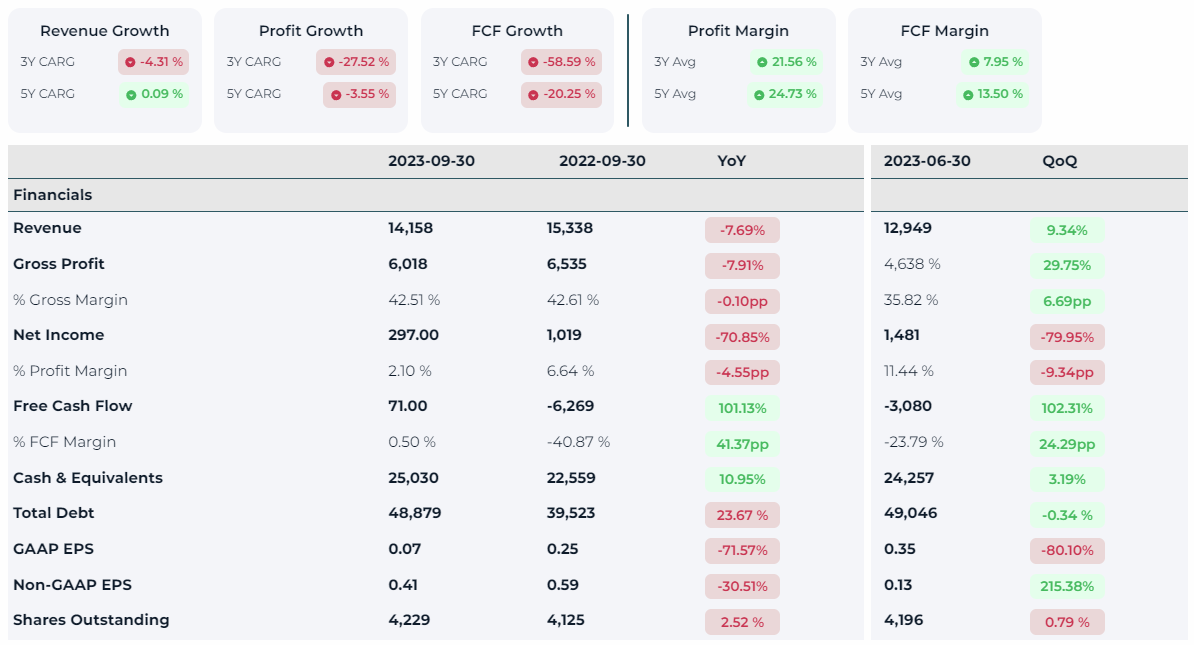

- Intel’s total revenue in Q3 2023 was $14.2 billion, marking an 8% decrease from Q3 2022.

Company Overview:

Intel Corporation, a global technology leader, has been at the forefront of innovation in the semiconductor industry. Founded in 1968, Intel’s contributions have been pivotal in the evolution of computing technologies. The company specializes in manufacturing microprocessors, chipsets, embedded processors, and network interface controllers, among others.

Intel’s Strategic Pivot Amidst Market Flux

Recent times have been a mix of challenges and opportunities for Intel. The company, once the undisputed leader in semiconductor technology, faces fierce competition from rivals like AMD and NVIDIA, who have made significant inroads into Intel’s market share. The rise of ARM-based processors and the increasing demand for specialized chips for AI and data centers add to the competitive pressure.

Intel’s response to these challenges has been multi-pronged. The company has accelerated its innovation cycle, focusing on next-generation chip technologies. Under the leadership of CEO Pat Gelsinger, Intel announced a significant investment in expanding its manufacturing capabilities, aiming to not only meet its own chip demands but also offer foundry services to other chipmakers.

Moreover, Intel is actively diversifying its product portfolio. Its recent advancements in AI, edge computing, and autonomous driving technologies signify a strategic shift.

Leading AI models, such as OpenAI’s ChatGPT, predominantly utilize Nvidia GPUs hosted in cloud environments. This reliance has contributed to Nvidia’s stock soaring by approximately 230% since the beginning of the year, in stark contrast to Intel’s 68% increase. This trend underlines why competitors like AMD and Intel are now introducing their own chips, aiming to challenge Nvidia’s strong market presence.

Although specifics were sparse, Intel’s Gaudi3 is set to rival Nvidia’s H100, a popular choice for entities constructing extensive chip networks for AI operations, and AMD’s upcoming MI300X. The Gaudi3 is expected to begin distribution to clients in 2024.

However, these strategic decisions come with their own set of risks. The high cost of chip manufacturing and R&D, coupled with the uncertain global economic landscape, poses significant challenges. The company’s ability to execute its ambitious plans while maintaining financial stability is a key factor to watch in the coming years.

Recent Financials:

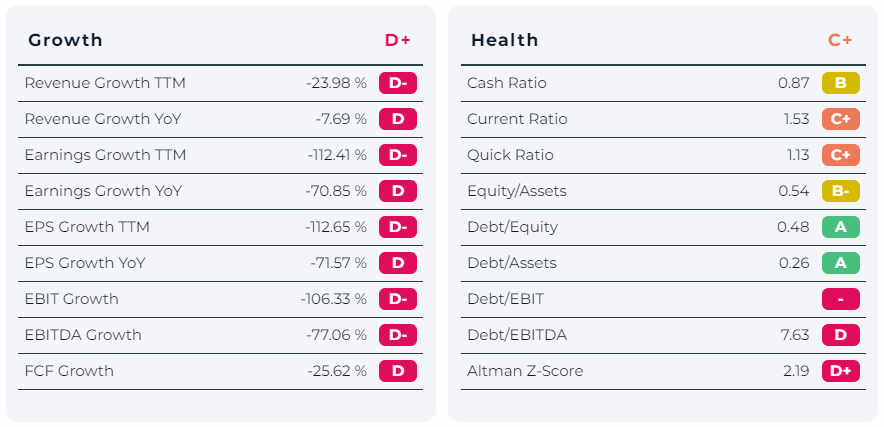

Intel Corporation’s recent financial performance reflects the challenges and resilience of a tech giant in a volatile market. In Q3 2023, the company reported a total revenue of $14.2 billion, a decrease of 8% from the same quarter in the previous year. This decline was primarily due to decreases in revenue across its major segments: the Client Computing Group (CCG) revenue decreased by 3%, the Data Center and AI Group (DCAI) by 10%, and the Network and Edge Group (NEX) by a significant 32%.

The company’s financial strategy also reflects a commitment to operational efficiency and cost management. By streamlining processes and optimizing resources, Intel aims to improve its profitability and shareholder value in the long term. This approach is crucial as the company faces intense competition from other tech giants and emerging players in the semiconductor industry.

In conclusion, Intel’s recent financial performance, though marked by challenges, showcases the company’s strategic efforts to remain a dominant player in the tech industry. The company’s focus on innovation, operational efficiency, and market adaptability will be key to its future success and financial stability.

Financial Bullet Points:

- Revenue (Q3 2023): $14.2 billion, down 8% YoY.

- Client Computing Group Revenue: Decreased by 3%.

- Data Center and AI Group Revenue: Decreased by 10%.

- Network and Edge Group Revenue: Decreased by 32%.

- Gross Margin (Q3 2023): 42.5%, slightly down from 42.6% YoY.

- Net Income (Q3 2023): $297 million, a substantial decline from $1.019 billion YoY.

- Earnings Per Share (Q3 2023): $0.07, with non-GAAP EPS at $0.41.

Business Model & Competitors Analysis:

Intel’s business model revolves around its dominance in CPUs, with expansion into data center solutions, IoT, and AI. The company’s shift towards providing foundry services marks a strategic expansion of its business scope.

Competitors like AMD, NVIDIA, and ARM pose significant challenges. AMD’s gains in the CPU market and NVIDIA’s dominance in GPUs and AI chips have encroached on Intel’s turf. ARM’s energy-efficient architecture is increasingly favored for mobile devices and is making inroads into servers, a traditional Intel stronghold.

Intel’s response lies in its comprehensive product range, manufacturing capabilities, and R&D investments. The company’s ability to innovate and adapt to market trends will be crucial in maintaining its competitive edge.

SWOT Analysis:

- Strengths: Strong brand, diverse product portfolio, manufacturing capabilities.

- Weaknesses: Margin pressures, high competition, execution risks on strategic shifts.

- Opportunities: Growth in AI, autonomous tech, and data centers.

- Threats: Rapid technological changes, competitive market dynamics, global economic uncertainties.

Investment Outlook:

Intel’s future performance hinges on its ability to innovate and adapt to market trends. The company’s investment in AI and IoT, along with its strategic focus on foundry services, positions it well for future growth.

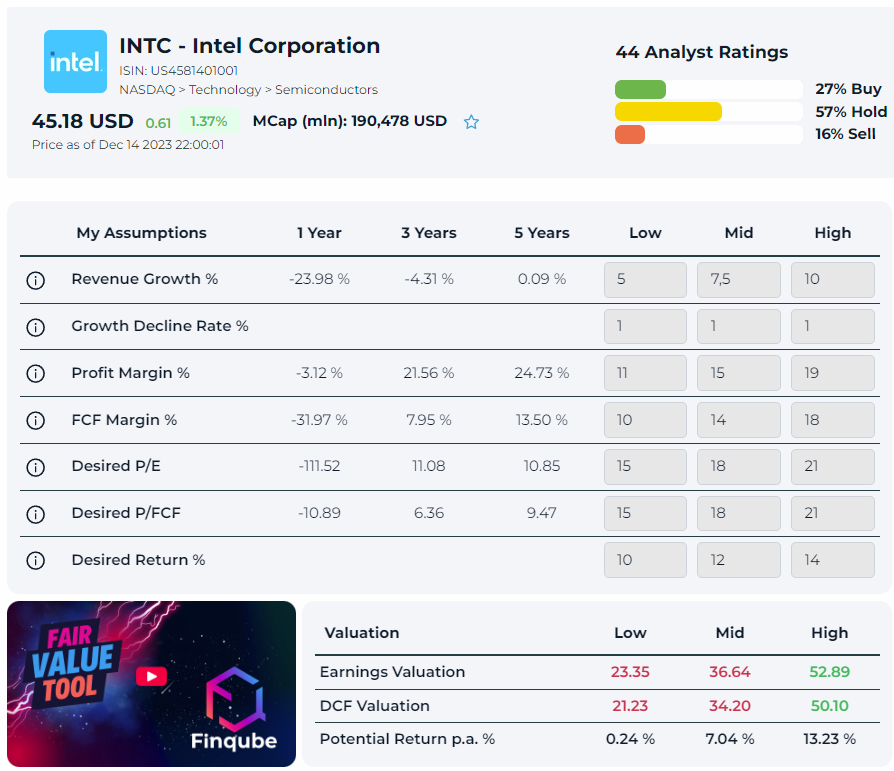

After conducting a comprehensive 10-year forecast, our analysis indicates that Intel’s current valuation appears to be justifiable, taking into account a range of scenarios. These scenarios are grounded in conservative (low), moderate (mid), and optimistic (high) financial assumptions, providing a robust framework for evaluating the company’s long-term potential.

Concluding Remarks:

In conclusion, Intel Corporation stands at a pivotal point. Its strategic pivots, financial resilience, and commitment to innovation are commendable. Yet, the road ahead is fraught with challenges and competition. Intel’s journey will be a testament to its adaptability and resilience in an ever-evolving tech landscape. For investors, keeping a keen eye on Intel’s execution of its ambitious plans will be crucial in assessing its long-term potential in the dynamic semiconductor industry.

Financial Data Source: https://finqube.io/

Disclosure according to §34b WpHG because of possible conflicts of interest: The author is not invested in the discussed securities or underlying assets at the time of publication of this analysis.