Nvidia has seen a significant rise in its stock price in recent years, going from around $30 in 2019 to around $330 at the end of 2021. Right now in December 2022, it’s trading at $165. The company is still the leading manufacturer of graphics processors, which are used in gaming, high-demand applications, and emerging technologies such as digital currency mining, autonomous driving, and artificial intelligence.

Nvidia’s Business Model and Sectors:

Nvidia operates in four main sectors: gaming, data center, professional visualization, and automotive. Gaming is currently the largest contributor to Nvidia’s revenue, with a 46% share, followed by the data center sector with a 40% share. The professional visualization sector has also seen strong growth, with an average revenue increase of 20% over the last five years. The automotive sector is smaller but has potential for growth given Nvidia’s partnerships with automakers and its hardware dominance in autonomous driving.

Latest Nvidia Quarterly Results and Stock Price:

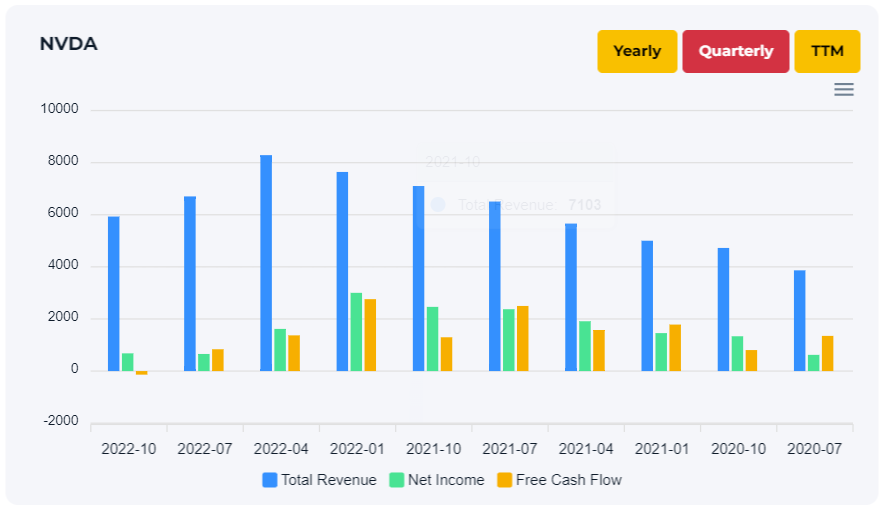

The latest quarterly results for Nvidia, released in October 2022, were below expectations due to weak demand for graphics processors in the gaming sector. The company attributed the weakness to a slowdown in the global PC market and a shift towards lower-priced graphics cards. As a result, the stock price has declined, but some analysts believe it is a good buying opportunity given the company’s long-term growth prospects.

Nvidia reported a Revenue of USD 5.9 billion, which means a decline of -11.53% to the previous quarter in July and a decline of -22.40% to the previous year in October 2022. However, many analysts expect a profitable business in the next years and are positive on the long-term view.

Recent News and Future Potential:

In recent news, Nvidia has announced a partnership with Samsung to bring its AI technology to Samsung’s devices. The canceled acquisition of ARM, a leading processor technology provider, for $40 billion. saves the company a lot of cash, however, it would give Nvidia a dominant position in the market for processor technology and further solidify its long-term growth potential.

Finqube.io Analysis

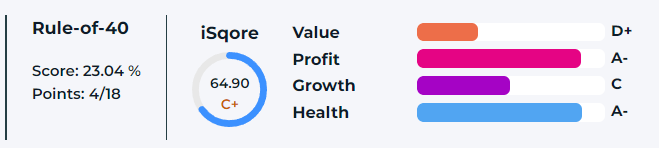

Our platform finqube.io provides us with an iSqore rating of 64.9 which is a C+ and caused by a shrinking revenue and profitability in recent quarters. Also, the Rule-of-40 doesn’t indicate any growth factor that´s not common for Nvidia.

Conclusion:

Overall, Nvidia is well-positioned for long-term growth in the graphics processor market even when the acquisition of ARM was canceled. The current dip in the stock price may present a good opportunity for investors to consider adding Nvidia to their diversified long-term portfolio.

It’s worth noting that Nvidia may or may not do well as the tech industry is highly competitive and unpredictable. It’s essential to do your own research and invest wisely. Disclosure according to §34b WpHG because of possible conflicts of interest: The author is not invested in the discussed securities or underlying assets at the time of publication of this analysis.