What is the Price-Sales Ratio?

The Price-Sales Ratio (P/S) is a financial metric that measures the value of a company’s stock price relative to its sales. In other words, it shows how much you are paying for each dollar of a company’s sales.

The P/S can be useful for comparing companies within the same industry, as well as for comparing different industries. A high P/S means that you are paying more for each dollar of sales, while a low PSR means that you are paying less.

Why is the Price-Sales Ratio Important?

The P/S can also be used to estimate a company’s future growth potential. Companies with high Price-Sales ratios are typically growing faster than companies with low Price-Sales ratios.

If you’re thinking about investing in a company, the P/S is a good metric to look at. It can give you an idea of whether or not the company is overvalued or undervalued.

However, it’s important to remember that the P/S is just one metric, and it should not be used alone to make investment decisions.

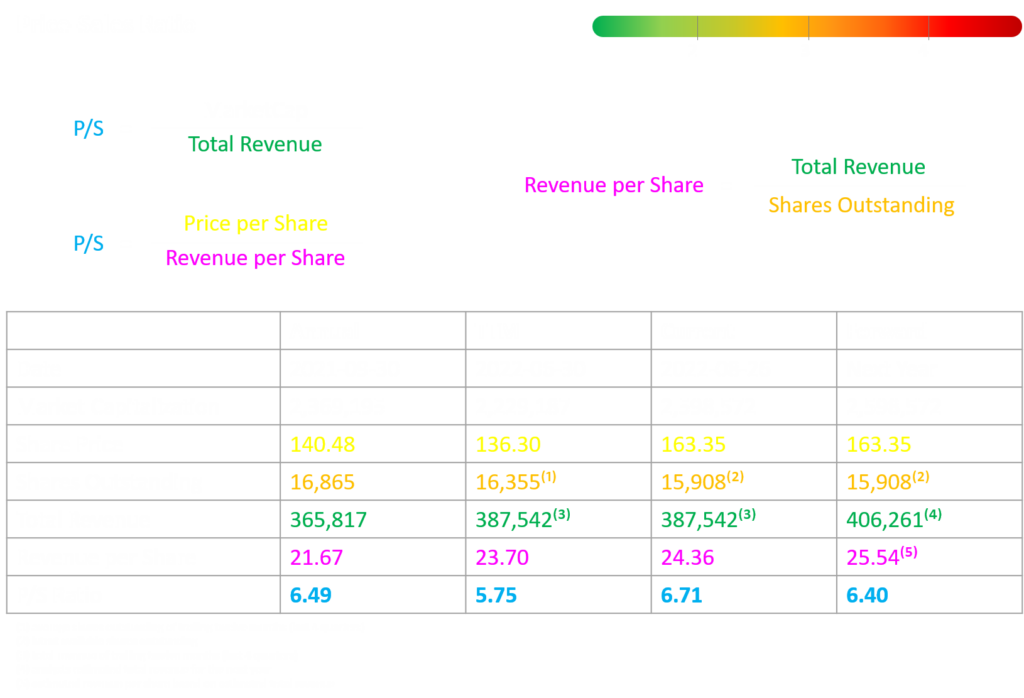

How is the Price-Sales Ratio Calculated?

The Price-Sales ratio is a financial metric that is used to assess the value of a company’s stock and is calculated by dividing a company’s market capitalization by its total sales.

When analyzing a company’s P/S, it is important to keep in mind that the metric is affected by a number of factors, including a company’s growth rate, profitability, and risk.

Despite its potential shortcomings, the P/S is a useful tool for investors and can provide insights into a company’s valuation.

What are the Limitations of the Price-Sales Ratio?

The Price-Sales Ratio is a popular metric used to value a company. However, the PSR has several limitations that investors should be aware of before using it to make investment decisions.

1. The P/S is based on historical data and may not be indicative of future performance.

2. The P/S only takes into account the sales price and does not consider other factors such as earnings or cash flow.

3. The P/S can be affected by one-time events such as asset sales or write-downs.

4. The P/S may not be accurate for companies with high levels of debt or companies that are not profitable.

Despite these limitations, the P/S can still be a useful tool for investors when used in conjunction with other valuation methods. When considering the P/S, it is important to keep in mind its limitations and to use other valuation techniques to get a more complete picture of a company’s worth.