What is the Price-Free-Cash-Flow Ratio?

The price-free-cash-flow ratio is a metric from the financial statement that is used to measure a company’s ability to generate cash flow. This ratio is important because it allows investors to see how well a company is doing in terms of generating cash flow and also provides insight into the company’s future prospects.

Why is the Price-Free-Cash-Flow Ratio Important?

Investors often use the price-to-earnings ratio (P/E ratio) to value stocks. However, the P/E ratio only tells you how much you’re paying for each dollar of earnings. It doesn’t tell you how much you’re paying for each dollar of free cash flow. That’s where the price-to-free-cash-flow ratio (P/FCF) comes in. The P/FCF ratio is a measure of how much you’re paying for each dollar of a company’s free cash flow.

Free cash flow is the cash that a company has left over after it has paid all of its expenses. It’s important because it’s the money that a company can use to pay dividends, buy back stock, or make acquisitions. The P/FCF ratio is important because it gives you a better idea of how much you’re paying for each dollar of a company’s free cash flow. In general, a lower P/FCF ratio is better than a higher P/FCF ratio. That’s because you’re paying less for each dollar of free cash flow.

So, if you’re looking at two companies with similar P/E ratios, but one has a lower P/FCF ratio, it may be a better value. Of course, there are other factors to consider when evaluating a stock. But the P/FCF ratio is an important metric to look at when trying to find good value stocks.

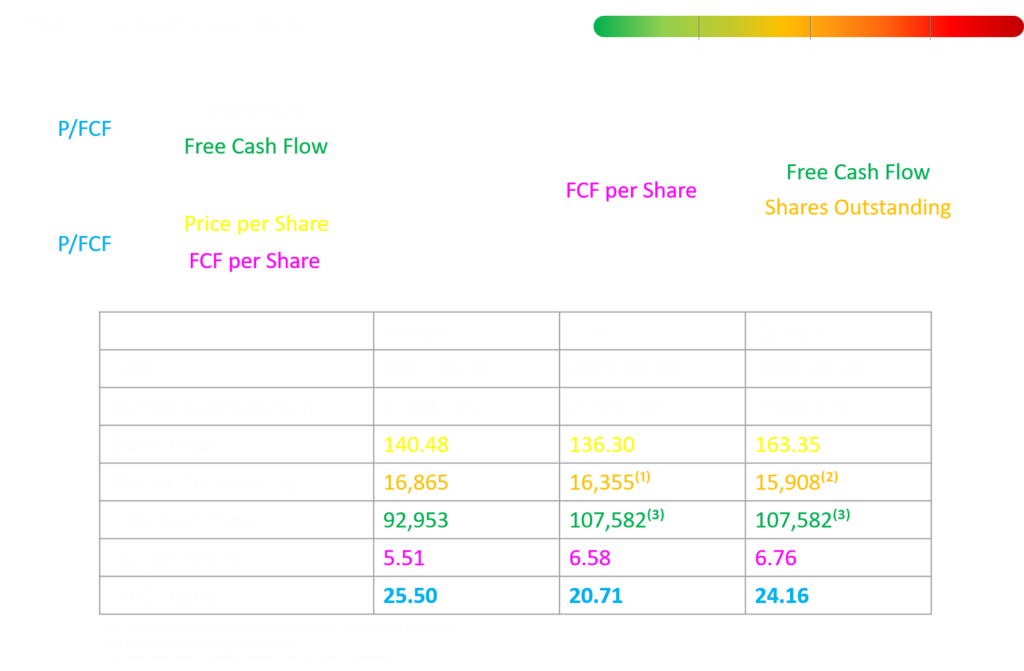

How is the Price-Free-Cash-Flow Ratio Calculated?

The price-free-cash-flow ratio is calculated by dividing the market value of a company’s stock by its free cash flow. This ratio is a good way to measure a company’s financial health because it shows how much cash flow is available to shareholders after all expenses have been paid. It can also be used to compare companies within the same industry.

When the ratio is high, it means that the company’s stock is overvalued and when the ratio is low, it means that the company’s stock is undervalued.

What are the Limitations of the Price-Free-Cash-Flow Ratio?

The price-free-cash-flow ratio is a metric that is often used by investors to value a company. However, there are some limitations to this ratio that investors should be aware of.

First, the price-free-cash-flow ratio does not take into account the company’s debt levels. This can be a problem because a company with a lot of debt may not be able to generate enough cash flow to service its debt payments.

Second, the price-free-cash-flow ratio does not take into account the company’s growth prospects. A company with strong growth prospects may be worth more than a company with weak growth prospects, even if the latter has a higher price-free-cash-flow ratio.

Third, the price-free-cash-flow ratio may be affected by accounting choices. For example, a company may choose to invest in long-term assets that will not generate cash flow for many years. This will reduce the company’s reported cash flow and increase its price-free-cash-flow ratio.

Fourth, the price-free-cash-flow ratio does not take into account the timing of cash flows. A company may have high cash flows in one year and low cash flows in another year. This can make it difficult to compare companies on this metric.

Overall, the price-free-cash-flow ratio is a useful metric for investors to use when valuing companies. However, investors should be aware of its limitations before making investment decisions.