It’s important to note that EPS can be either positive or negative, depending on whether a company is profitable or not. If a company has negative EPS, its P/E will be negative as well. Further, the P/E can be calculated for different periods based on earnings and price:

- Yearly > share price and earnings per share from the last annual income statement

- TTM > share price from the latest quarterly results and the sum of the last 4 quarterly earnings per share

- Current or Trailing> current shares price and the sum of the last 4 quarterly earnings

What are the Limitations of the Price-Earnings Ratio?

One limitation of P/E is that it only looks at a company’s share price and EPS, and doesn’t take into account other important factors such as debt levels, cash flow, or future growth prospects. As such, it should only be used as one tool in an investor’s overall decision-making process.

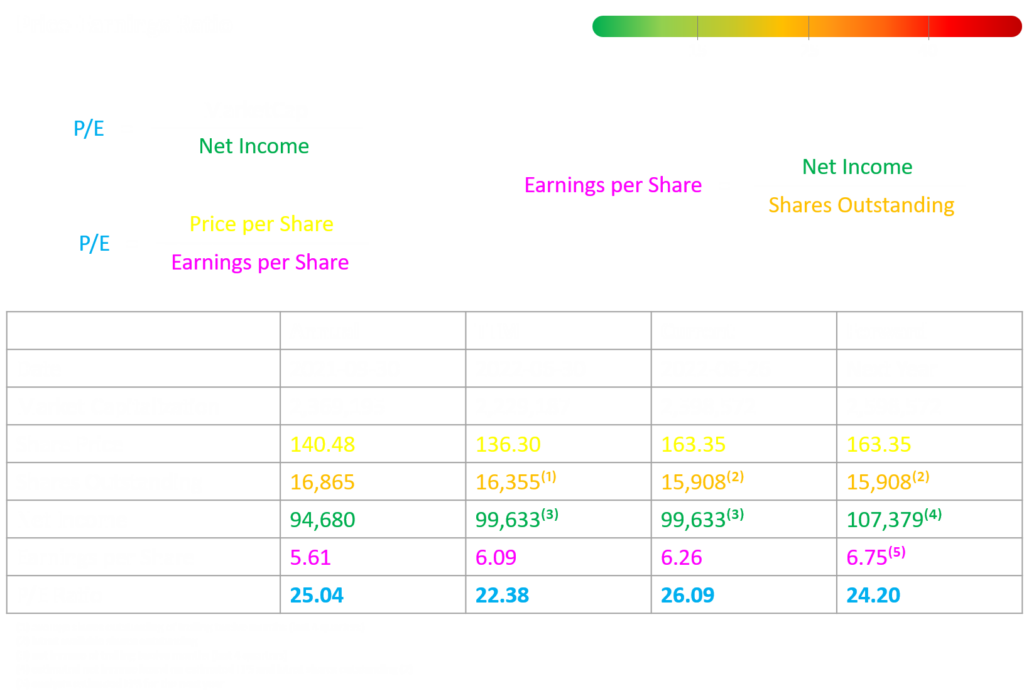

Another limitation of P/E is that it can be affected by the outstanding shares of a company. If a company has decreased its outstanding shares but the earnings are equal to the previous year, the EPS of the company is now higher. And if the company’s stock price has not changed over that period, your P/E is lower even though the earnings have decreased.

Therefore it’s important to not only focus on P/E. You should also compare the earnings and outstanding shares of the company.

What is the Price-Earnings Ratio?

The Price-Earnings ratio (P/E) is a financial metric that measures the relative cost of a company’s share price to its earnings per share. In other words, it shows how much investors are willing to pay for each dollar of a company’s earnings.

P/E is often used to compare companies within the same industry, or to compare the overall market to historical averages. A high P/E indicates that investors are willing to pay more for the company’s earnings, while a low P/E indicates that they are willing to pay less.

Why is the Price-Earnings Ratio Important?

P/E is important because it provides a way for investors to compare different companies or markets on a level playing field. By comparing the P/E of two companies, investors can get an idea of which is relatively cheaper or more expensive.

P/E can also be used as a tool for identifying potential investment opportunities. If a company’s share price is low relative to its earnings, it may be undervalued by the market and therefore represent a good investment opportunity.

How is the Price-Earnings Ratio Calculated?

The Price-Earnings Ratio is calculated by dividing a company’s share price by its earnings per share (EPS). For example, if Company XYZ has a share price of $10 and an EPS of $2, its P/E would be 10 divided by 2, or 5.

It’s important to note that EPS can be either positive or negative, depending on whether a company is profitable or not. If a company has negative EPS, its P/E will be negative as well. Further, the P/E can be calculated for different periods based on earnings and price:

- Yearly > share price and earnings per share from the last annual income statement

- TTM > share price from the latest quarterly results and the sum of the last 4 quarterly earnings per share

- Current or Trailing> current shares price and the sum of the last 4 quarterly earnings

What are the Limitations of the Price-Earnings Ratio?

One limitation of P/E is that it only looks at a company’s share price and EPS, and doesn’t take into account other important factors such as debt levels, cash flow, or future growth prospects. As such, it should only be used as one tool in an investor’s overall decision-making process.

Another limitation of P/E is that it can be affected by the outstanding shares of a company. If a company has decreased its outstanding shares but the earnings are equal to the previous year, the EPS of the company is now higher. And if the company’s stock price has not changed over that period, your P/E is lower even though the earnings have decreased.

Therefore it’s important to not only focus on P/E. You should also compare the earnings and outstanding shares of the company.