What is the Price-Book Ratio?

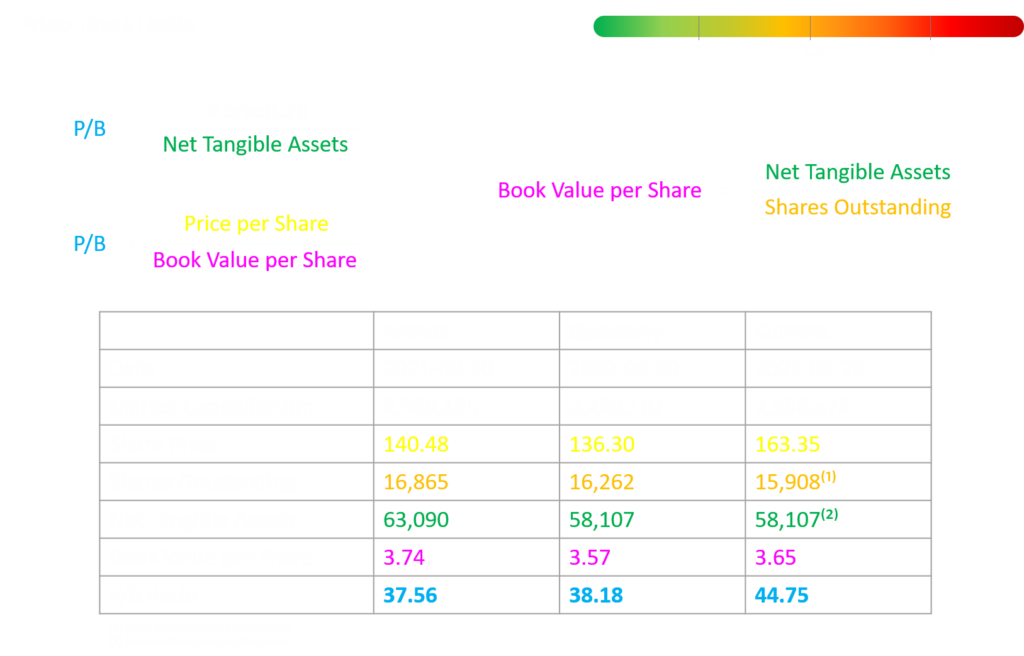

The Price-Book Ratio (P/B) is a financial statement metric used to compare a company’s market value to its book value. It is calculated by dividing the company’s market value per share by its book value per share and is a valuable metric for investors because it can give them an idea of whether a company is undervalued or overvalued.

Investors should use the Price-Book Ratio in conjunction with other metrics, such as earnings and cash flow, to get a comprehensive picture of a company’s valuation.

Why is the Price-Book Ratio Important?

The Price-Book Ratio is important because it provides investors with a way to compare the value of a company’s stock to its book value. The book value is the net assets of a company. In other words, if a company liquidated all of its assets and paid off all its debt, the value remaining would be the company’s book value.

Investors use the Price-Book Ratio to help them make investment decisions. They may use this ratio to determine whether a company’s stock is undervalued or overvalued. They may also use this ratio to compare the relative values of different companies stocks.

How is the Price-Book Ratio Calculated?

The Price-Book Ratio is a metric that is used to measure the value of a company’s stock. This ratio is calculated by dividing the market value per share by the book value per share. The market value per share is the current market price of one share of the company’s stock. The book value per share is the value of the company’s net tangible assets divided by the number of shares outstanding.

What are the Limitations of the Price-Book Ratio?

One limitation is that the ratio does not take into account the company’s debt levels. This can be a problem because a company with a high level of debt will have a higher price-book ratio than a company with a low level of debt, even if they are both equally profitable.

Another limitation is that the ratio does not take into account the company’s growth prospects. A company with strong growth prospects typically has a higher price-book ratio than a company with weak growth prospects.

Finally, it should be noted that the price-book ratio is not necessarily accurate for companies in certain industries. For example, companies in the technology sector often have high price-book ratios even though they may not be particularly profitable.

Despite these limitations, the price-book ratio can still be a useful tool for valuation purposes. However, it is important to be aware of its limitations and to consider other factors when making investment decisions.